Economic Indicators Point to Cooling Economy as Supplier Inflation Moderates and Unemployment Claims Rise.

The latest Economic Indicators reveal that the U.S. economy is displaying new signs of cooling, with a decline in supplier inflation and an uptick in applications for unemployment benefits.

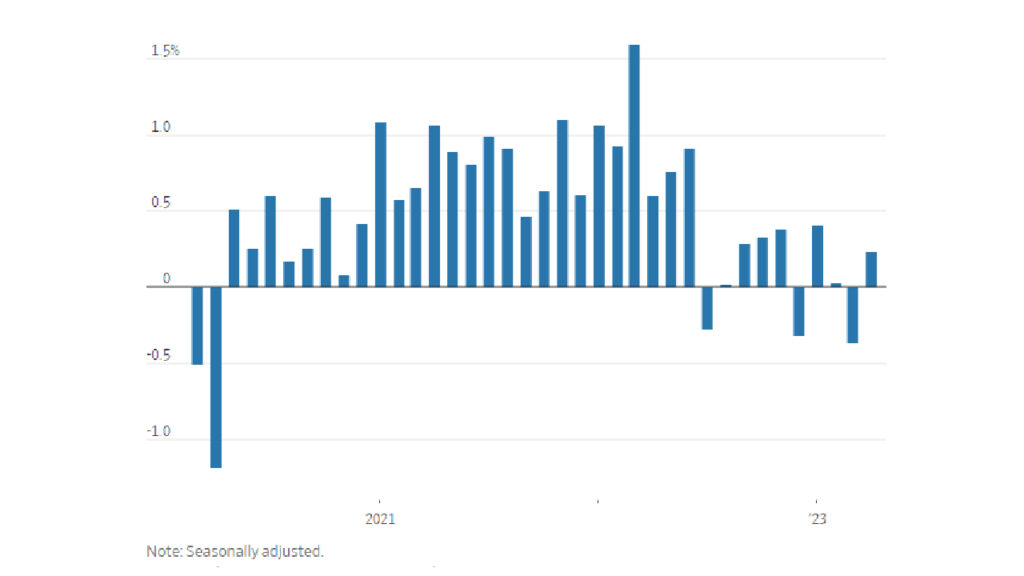

According to the Labor Department’s report on Thursday, the producer-price index, which serves as a gauge for supply conditions across the economy, experienced a 2.3% increase in April compared to the previous year. This growth rate represents the slowest pace since January 2021, signaling a decrease from the 2.7% surge observed in March.

In a separate report by the Labor Department, it was noted that filings for unemployment benefits by workers rose by 22,000, reaching a seasonally adjusted total of 264,000 last week. This figure marks the highest level since October 2021. Although jobless claims remain historically low, they have been on an upward trend this year, indicating a rise in layoffs. Various large companies in industries such as technology, real estate, and finance have recently announced cutbacks.

Get The New York Times and Barron’s News 3-Year Digital Subscription for $129

Despite these trends, the labor market remains robust. In April, employers added 253,000 jobs, representing the highest gain since January, and the unemployment rate dropped to its lowest level since 1969.

The producer prices also experienced a slight increase of 0.2% in April compared to the previous month, following a revised decline of 0.4% in March. The Labor Department attributed the majority of this month’s increase to higher prices for supplier services. Notably, April’s increase aligns with the average monthly rise of 0.2% observed in the two years prior to the pandemic.

Looking ahead, PNC economist Kurt Rankin cautioned that as the second half of 2023 progresses, producers may witness their customers struggling to cope with elevated costs. Rankin further emphasized that job cuts have already commenced in sectors such as technology and financial services as businesses anticipate weaker demand and adjust their outlooks.

The moderation of supplier inflation can potentially signal a future decrease in consumer prices if businesses choose to limit price hikes or refrain from raising them altogether.

Get The Economist and The Wall Street Journal Bundle Digital Subscription for $129

While consumer inflation slightly eased in April, it remains at historically high levels. According to the Labor Department’s report on Wednesday, the consumer-price index recorded a 4.9% increase last month compared to the previous year, a slight decline from March’s 5% rise. Although this figure has decreased from its peak of 9.1% in June 2022, it still significantly exceeds the Federal Reserve’s 2% inflation target.

Given these circumstances, Federal Reserve officials are expected to maintain their plan to pause interest-rate hikes at their upcoming meeting in June. Over the past year, the Fed has implemented aggressive rate increases to mitigate inflation by slowing down economic activity. The central bank is now keen to observe signs of inflation subsiding towards its target.

In addition, the broader economy has exhibited signs of cooling, with U.S. economic growth experiencing a decline in the first quarter, and consumer spending remaining stagnant in February and March.