Markets

Regional Banks Face Added Strain as Bond Sell-Off Intensifies

Regional Banks Face Growing Pressure as Bond Sell-Off Intensifies. Investors are increasingly demanding higher yields to hold regional bank bonds, which poses a further strain on lenders already grappling with rising deposit costs.

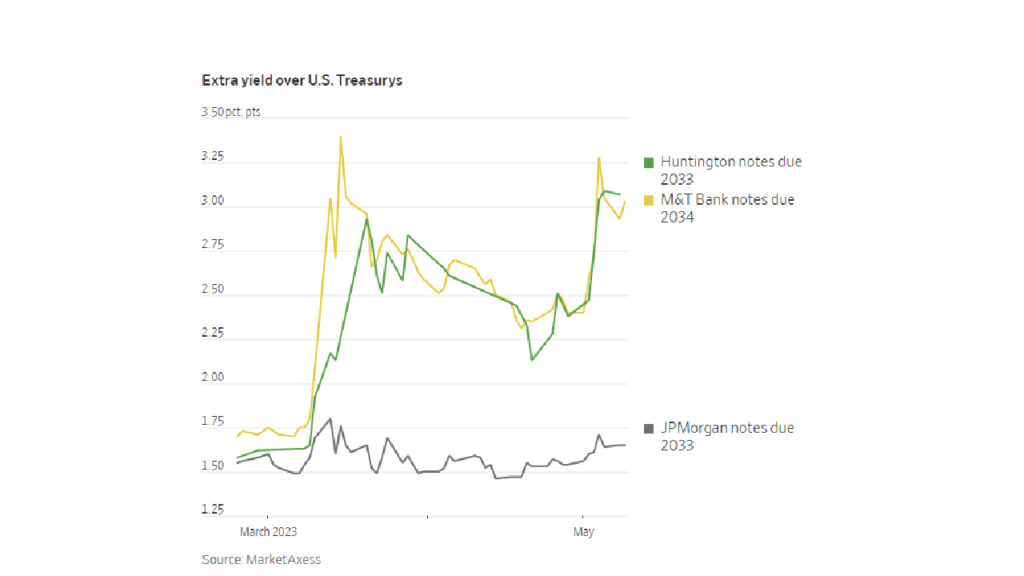

The spread, or the additional yield, of regional bank bonds over U.S. Treasurys has surged by approximately 2 percentage points or more since early March. The failures of Silicon Valley Bank and Signature Bank triggered a broad investor retreat from all but the largest U.S. banks.

This spread widening is based on an analysis of actively traded bonds from lenders with assets ranging from $150 billion to $220 billion. Examples include Huntington Bancshares, headquartered in Columbus, Ohio, and M&T Bank, based in Buffalo, New York. These banks are small enough to raise concerns about their financial health while still having a significant volume of outstanding bonds.

In contrast, the spread on 10-year JPMorgan Chase bonds only increased by around 0.1 percentage point during the same period. This discrepancy reflects JPMorgan Chase’s financial strength and the perception that such a large bank would not be allowed to fail by the U.S. government.

Get Wall Street Journal 2-Year Print Subscription Take for $480

Following the bank failures in March, federal regulators have indicated their intention to potentially require banks with as little as $100 billion in assets to issue more long-term bonds, subjecting them to similar requirements as systemically important banks.

The purpose of these regulations is to establish a debt buffer that can be converted into equity if a bank becomes insolvent, reducing the need for taxpayer-funded bailouts. However, this could lead to regional banks having to sell bonds in a market that is not particularly interested in purchasing them.

Andrew Arbesman, a senior fixed-income research analyst covering banks and insurance companies at Neuberger Berman, noted that wider spreads and increased funding costs have compelled equity analysts to adopt a negative outlook on regional banks. The expectation is that these banks will struggle to generate returns as they have in the past.

Higher yields on regional bank bonds may not immediately result in higher borrowing costs for these lenders. Their impact may also be limited, considering that regional banks primarily rely on deposits rather than bonds for funding, even after new regulations are implemented.

Nevertheless, higher borrowing costs can create challenges for midsize banks, particularly when they are already compelled to raise deposit rates to retain customers.

Get Wall Street Journal Newspaper for $318

For instance, take Huntington, which had approximately $169 billion in interest- or dividend-earning assets in the first quarter of the year, along with $8.8 billion in outstanding bonds. If the bank were to replace all its bonds over time with new ones that paid an additional 1.5 percentage points in interest, its annual net interest income would decrease by around $130 million.

In comparison, the bank generated approximately $5.3 billion in net interest income last year and $1.4 billion in the most recent quarter. While the latter figure was up 23% compared to the previous year, thanks to rising rates on floating-rate assets, it was down almost 4% from the previous quarter, partly due to increasing deposit costs.

According to a recent report by Barclays, Huntington might need to issue up to $6 billion in new bonds to comply with expected regulations. Assuming bonds are issued at current rates, there could be further margin erosion, although the impact would depend on how Huntington invests the proceeds from the bonds. Barclays also suggests that the bank might only need to issue as little as $1 billion, and the rules could be structured to allow banks to issue bonds over an extended period.

Despite the situation, many investors and analysts believe that regional bank bonds have been oversold. They note that most banks have reported relatively stable deposit levels despite recent market turbulence.

As of Tuesday, Huntington’s 5.023% bonds due in 2033 were trading at